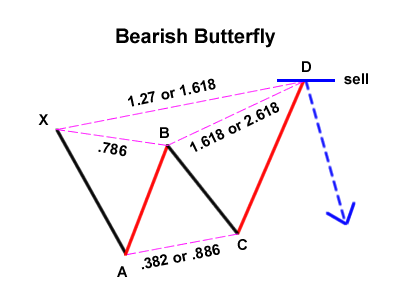

The pattern can be described in the following manner:ī: Point B represents a prominent peak. The investor will attempt to sell at point D if the ABCD pattern is bearish. At point B the investor should aim for a minimum profit target. As with the AB leg, and for the same reasons, the CD leg cannot have points higher than C or lower than D. It is referred to as the second low.ĭ: Point D must be below point B. In order to comply with the ABCD pattern, A and B must be the highest and lowest points of the AB leg, respectively.Ĭ: Point C must be below point A, but not below point B. Even if the stock price may climb or drop throughout the AB leg, there cannot be a point of value above A or below B. The pattern can be described in the following manner:ī: Point B is at an all-time low. The investor will try to purchase at point D if the ABCD pattern is bullish. Consequently, part-time traders should also be on the lookout for this pattern, as it occurs over lunch. window, which is thought to be between 1 p.m. The entry point for investments typically falls inside the 2 p.m. It is also an “afternoon pattern,” which means that it begins later in the day. When Should The ABCD Pattern Be Used?ĭue to its simplicity and the fact that the majority of other patterns are built on it, the ABCD pattern is an excellent one to utilize when beginning trading. This offers traders the confidence to enter or exit a position at higher prices. A convergence of patterns atop the ABCD pattern is typically indicative of a stock’s predictable behavior. Recognizing an ABCD pattern is the first step in recognizing other patterns, such as a flag pattern or a rising/falling wedge. If this is the case, traders can utilize the Fibonacci sequence to determine when to enter or leave their positions by plotting the value of D. Ideally, point C will be 61.8% of point A. In the case of ABCD pattern trading, the important Fibonacci ratio of 61.8% is sought by traders. This is because it derives from the Fibonacci sequence, which includes dividing one number by another as part of a pattern. Why Is The ABCD Pattern Significant?ĪBCD pattern trading is the easiest to recognize of all market patterns and serves as the foundation for subsequent patterns. Once the stock breaks above point A, the trade plan is deemed successful, and profit-taking at point D is considered. We are anticipating that the stock will break above point A for an intraday breakout, and we are managing our risk accordingly. Once this higher low is established (C), we plan our trade with a risk level of B. On the next decline, we hope the stock will demonstrate strength by establishing a higher bottom (above point B). When purchasers prevail over sellers, an intraday low is formed (B). This increase is inevitably followed by a healthy reversal when profit takers sell their shares. The pattern is distinguished by an initial spike (A) in which the stock price achieves its daily high. This pattern is typically used intraday but can also be adapted to other timeframes. The ABCD pattern is a chart pattern used to discover probable long trade setups in the chat.

ABCD PATTERN STOCKS HOW TO

How To Avoid Heavy Losses With The ABCD Pattern.How to Use The ABCD Pattern in Trading?.

0 kommentar(er)

0 kommentar(er)